1 including information services on the financial market and the commodity market

2 presented as „Other revenue” in „Revenue” in consolidated statement of comprehensive income

3 Associate company (33.33%); KDPW Group offers post-trading services on the financial market

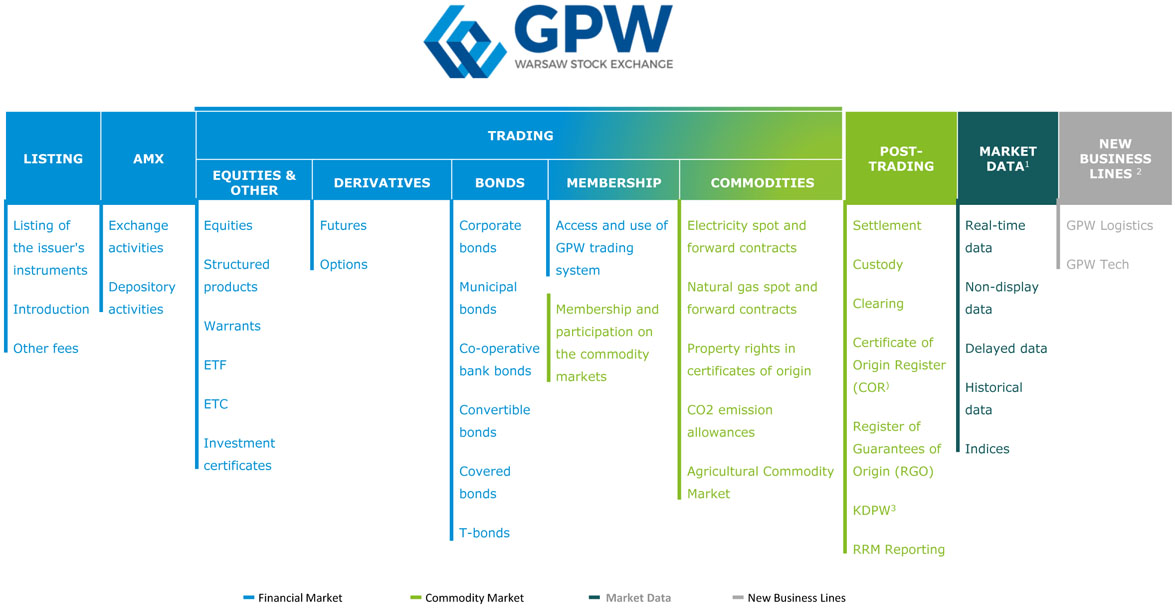

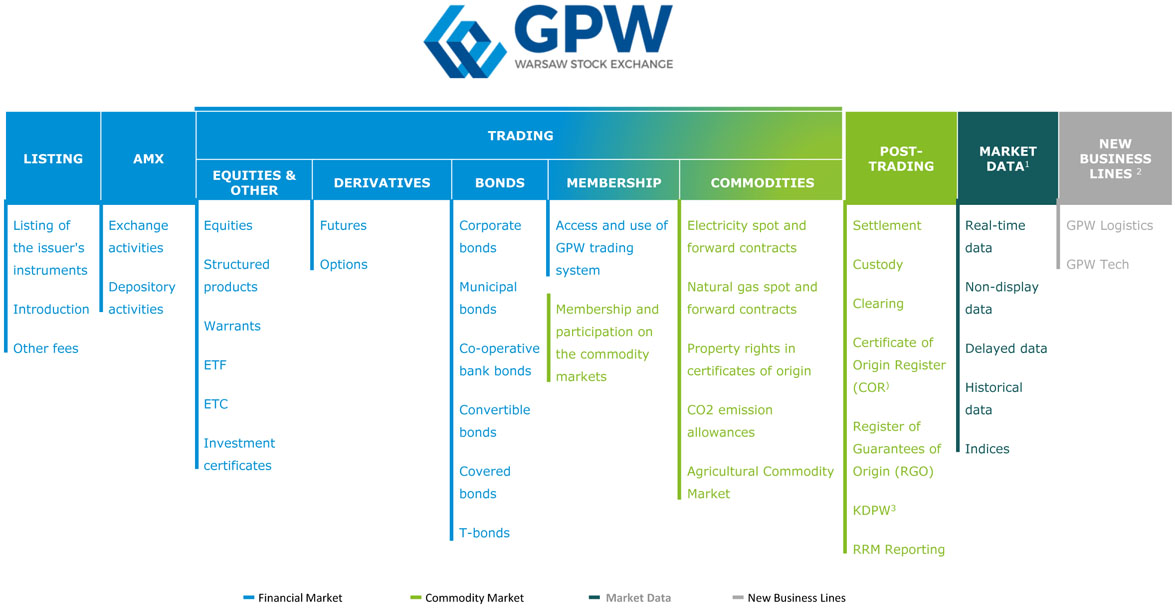

Listing

Listing includes admission and introduction to exchange trading and listing of securities on the markets organised and operated by the GPW Group.

Trading

GPW organises trading in shares, other equity financial instruments and other cash market instruments (structured certificates, ETFs, warrants, investment certificates) on the Main Market, New Connect and GlobalConnect. The value of trading and the number of listed instruments make GPW one of the fastest growing stock exchanges among European regulated markets and alternative markets regulated by stock exchanges, and the largest national stock exchange in Central and Eastern Europe.

The Main Market offers, among others, derivatives trading. The Warsaw Stock Exchange is the largest derivatives market in the CEE region. The most liquid derivative instruments, generating the highest trading volumes, have for years been the WIG20 futures.

Corporate bonds, municipal bonds, co-operative bonds, Treasury bonds and covered bonds are traded on Catalyst on the GPW and Bondspot trading platforms. Wholesale trading in Treasury bonds is organised by Treasury BondSpot Poland.

The Group organises trading on the markets operated by Towarowa Giełda Energii S.A., including the Electricity Market, the Gas Market and the Property Rights Market. The Agricultural Market launched in March 2020 offers trade in agricultural crops.

Post-trade services

Post-trade services for the financial market operated by GPW and BondSpot, including depository, clearing and settlement services, are offered by GPW's associate KDPW (the Central Securities Depository of Poland) and its subsidiary KDPW_CCP. Transactions concluded by TGE Members on the markets are cleared by Izba Rozliczeniowa Giełd Towarowych (IRGiT), a subsidiary of TGE. Clearing covers transactions in exchange-traded commodities and financial instruments that are not securities. IRGiT clears the entire volume of electricity and gas sold in Poland on the exchange market. Using modern IT systems and a proprietary settlement model, IRGiT clears and settles transactions concluded on TGE’s Financial Instruments Market (RIF), where TGe24 index futures and gas-based financial instruments are traded.

Armenia Stock Exchange

Armenia Stock Exchange (AMX) is a company based in Yerevan which organises trading in financial instruments in Armenia. AMX owns 100% shares of Central Depository of Armenia (securities depository). Central Depository of Armenia provides clearing of transactions in equity instruments and corporate debt securities (both on the organised exchange market and over-the-counter).

TGE Registers

TGE operates the Register of Certificates of Origin for electricity produced from renewable energy sources and the Register of Certificates of Origin for property rights to certificates of origin. Guarantees of origin of energy are part of the EU’s environmental policy used to disclose the types of sources and fuels from which electricity is generated.

TGE also offers the Register of Guarantees of Origin which records renewable energy and offers over-the-counter trading of environmental benefits arising from its production. Unlike certificates of origin, guarantees are not linked to property rights or to a RES support scheme; they only have an informative function. There is no obligation to purchase guarantees, but they can be bought by entities which wish to prove that a given amount of the energy they consume was produced from renewable sources. Since November 2014, TGE supports trading in guarantees of origin of energy.

Information services

GPW collects, processes and sells data from all markets operated within the Group. The main clients using the data are specialised data vendors who distribute the data made available by GPW in real time to investors and other market participants. The data vendors include news agencies, investment firms, internet portals, IT companies and other entities. GPW also offers data for non-display use. In addition to trading data, the Company provides data vendors with reports of issuers listed on NewConnect and Catalyst.

A member of the GPW Group, GPW Benchmark is the licensed administrator of regulated data benchmarks (WIG Exchange Index Family, CEEplus) and benchmarks that are not interest rate benchmarks (TBSP.Index). GPW Benchmark provides the WIBID and WIBOR Reference Rates and the WIRON Transactions-based Benchmarks. WIBOR has the status of a critical benchmark of systemic importance for the Polish money market, used for the valuation of most bank loans, derivatives and debt instruments issued in PLN.

GPW collects, processes and sells data from all markets operated within the Group, including data from Towarowa Giełda Energii.

GPW Logistics

The company provides tools based on artificial intelligence to automate and digitise processes for the Transport, Shipment and Logistics (TSL) industry and to ensure the security of transport document flows.

GPW Tech

The core business of the company is to build, develop and commercialise IT solutions supporting dedicated to the financial market.