History

Polish capital market traditions go back to 1817, when the Warsaw Mercantile Exchange was established. Following the overthrow of Poland's former communist regime in 1989, WSE was created as a joint-stock company on April 12, 1991 by the State Treasury pursuant to the Foundation Act for Giełda Papierów Wartościowych w Warszawie SA (The Warsaw Stock Exchange Company).

See moreStrategy

Strategic development directions GPW Group 2025-2027

On 27 November 2024 the GPW Supervisory Board has approved the GPW Group’s Strategic directions of development 2025-2027.

See moreAuthorities

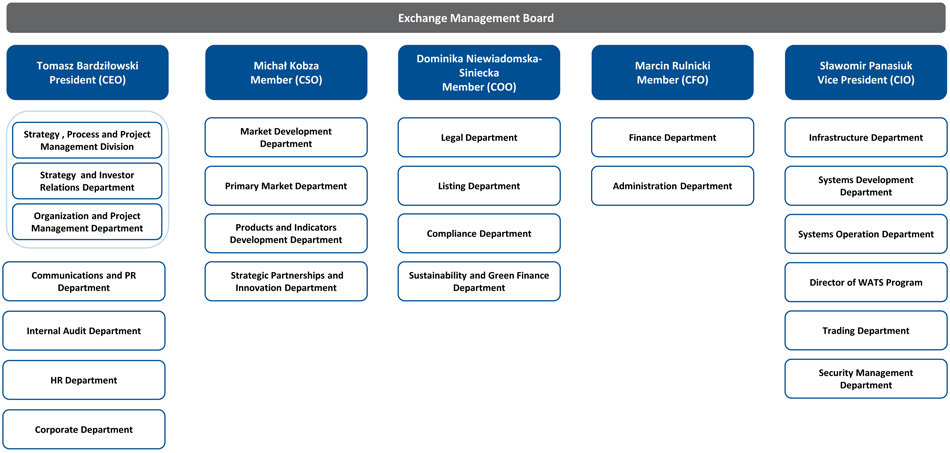

The highest authority of the Warsaw Stock Exchange is the General Meeting of Shareholders of the Exchange. All shareholders of the Exchange are given the right to attend the General Meeting. The competences of the General Meeting include, among others, changes to the Articles of the Association and the election of members of the Exchange Supervisory Board.

See moreShareholders

Warsaw Stock Exchange (GPW) debuted on the market of the Warsaw Stock Exchange on November 9th, 2010. Currently, the shareholder structure presents as follows:

Best practice

Corporatee governance is a set of rules of conduct, designed for both corporate governing bodies and their members, and for majority and minority shareholders.

See moreGeneral meeting of shareholders

Announcement on convening an Extraordinary General Meeting of the Warsaw Stock Exchange (“Giełda Papierów Wartościowych w Warszawie S.A.”)

See moreCorporate governance

Statement of applications of corporate governance standards published in the annual report of GPW Group for 2022

See moreGPW CAPITAL GROUP

The Warsaw Stock Exchange is the parent entity of the Warsaw Stock Exchange Group, whose offer includes the financial market and the commodity market.

Get to know GPW groupGPW INVESTOR RELATIONS

The Warsaw Stock Exchange was listed on GPW on 9 November 2010. The Company participates in the mWIG40 index and the WIG ESG index.

Get to know GPW IRESG GPW

The Warsaw Stock Exchange and the companies of the GPW Group conduct their operations bearing in mind not only the highest business standards but also social, employee, ethical and environmental concerns.

Get to know ESGEXCHANGE COURT

Exchange court settled civil disputes for property rights between participants in exchange transactions.

Read more