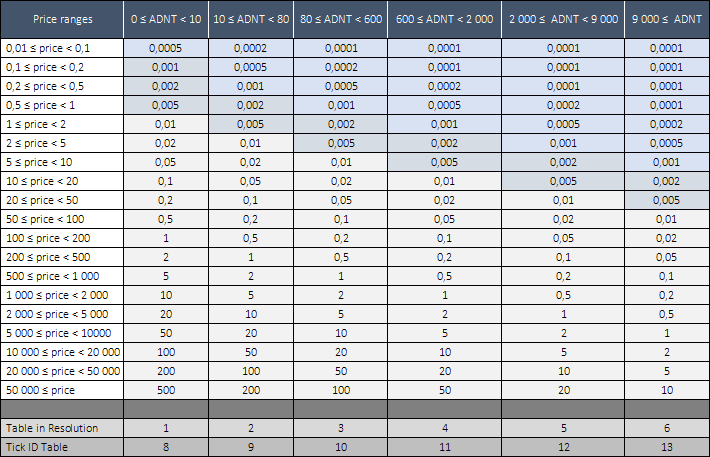

Tick size tables

|

||

|

|

Effective March 4, 2019, there has been a change in the listing steps for equities, ETFs, stock futures and currency futures. The prices of shares and ETFs are quoted with accuracy of PLN 0.0001 taking into account the current liquidity band specified in the tick Table ID. The prices of currency futures and stock futures are quoted with accuracy up to PLN 0.0001. Additionally, for currency futures contracts the unit of quotation has been changed from 100 to 1. |

|

|

| Applicable tick size tables |

| Up-to-date tick tables for shares |

| Shares and ETFs tick table assignment - valid on April 1th 2025 |

1. SHARES TICK SIZE DETERMING RULES

The basis for determining the tick size table is the average daily number of transactions in the liquidity-critical market for a given share and from the price limit in the order. Based on the estimation of the average number of transactions during the period subject to such estimation, the Average Daily Number of Transactions (ADNT) is calculated. The calculated ADNT is then inserted into Tick size Table and based on that the instrument is assigned to the appropriate liquidity band. At the same time, based on the current price of the instrument, the instrument is assigned to the appropriate line in the table referring to the minimum value of price change (tick table) at a given price range.

Liquidity bands

Debut shares

|

For debut shares for which there is insufficient data to estimate the ADNT, a temporary liquidity band is used until the average daily number of transactions is published by the competent authority, which corresponds to Table 6 of the WSE Resolution (corresponding to UTP technical table 13). This band is intended for instruments with the highest liquidity. |

2. STOCK FUTURES

As a result of the change of the tick size , the prices of single-stock futures contracts are determined with a greater precision of PLN 0.0001 than before. There is one tick size independent from the futures price. The tick size is lower than 1 grosz - the accuracy is 1/100th of a grosz; however, the contract price may not be lower than 1 grosz.

Multiplier change

According to the stock futures standard, the number of shares per contract (the multiplier) may be 100 or 1000 shares. The multiplier established for a given class of contracts is valid for all series of this class successively introduced into exchange system trading. If, for example, a multiplier of 100 is determined for contracts on shares of KGHM S.A., then the multiplier is applied to all series of these contracts introduced to exchange trading in cycles.

It should be remembered that in the case of operations on shares being the underlying instrument for futures contracts, such as preemptive rights, par value change or extraordinary dividend rights, the multiplier may change and may be different than 100 or 1000 shares. Non-standard multiplier amounts such as 102 or 108 shares are possible. Since in such a case, when calculating the result from an investment in futures contracts, we may obtain a result with the accuracy of more than one grosz, it is necessary to mathematically round off the result to a full grosz. The result from the investment per 1 futures contract is rounded up.

The tick size for stock futures may be different than for stock (the underlying instrument)

The tick size for shares is determined individually for each of these instruments and depends on the current price level of the shares and their liquidity. In the case of single-stock futures contracts, there is one tick size (PLN 0.0001) for all quoted contract classes and it is independent of the instruments' tick sizes. It should be noted that in the vast majority of cases the tick size for single-stock futures contracts is not identical to the tick size for the underlying stock. The tick size for both instruments is identical as long as the tick size for shares is also PLN 0.0001. This tick size is assigned to shares with a very low price and higher liquidity (for details of the tick size for shares, see WSE Rules)

This fact should be taken into account when investing in futures contracts on stocks of companies.

3. CURRENCY FUTURES

The tick size before the change was PLN 0.01 and it concerned the price of a futures contract expressed per 100 units of a given currency (100 EUR, 100 USD, 100 GBP, 100 CHF).

The tick size applicable after the change is 0.0001 PLN and the contract rate is expressed per 1 unit of a given currency (1 EUR, 1 USD, 1 GBP, 1 CHF). However, the price of the contracts may not be less than one grosz

The change of the tick size and the quotation unit for currency futures contracts concerned all rates applicable to this instrument, including daily and final settlement rates. Please note that the final settlement rate after the change is the average rate for a given currency (EUR, USD, GBP, CHF) established by NBP on fixing on the day of expiration of given contracts and this rate is not multiplied by 100 as it was before the change.